Numerous families face trouble spending their bills that are monthly time. Their economic issues aren’t astonishing. Wages have already been stagnant in the us for 30 to 40 years. This stagnation helps it be problematic for people and families to save cash — they are too focused on putting meals up for grabs to place any such thing apart.

While spending bills that are monthly a challenge, life gets also harder when unanticipated costs arise. Where can you find a supplementary $100 as soon as your vehicle requires repairs or perhaps you need to go directly to the medical practitioner?

Lots of people utilize bank cards to cover these expenses that are unexpected. Nonetheless, depending on charge cards can cause a spiral of high-interest financial obligation. As a whole it is a good idea to stay away from your bank cards if you don’t are able to cover from the stability the exact same thirty days. Employing a safe cash advance is usually an improved option which will help you obtain right straight right back in your legs without forcing you into a never-ending period of financial obligation. Before you accept an offer, however, you will need to discover ways to recognize safe loans that match your needs.

Exactly Exactly How Do a Safe is identified by you Cash Advance?

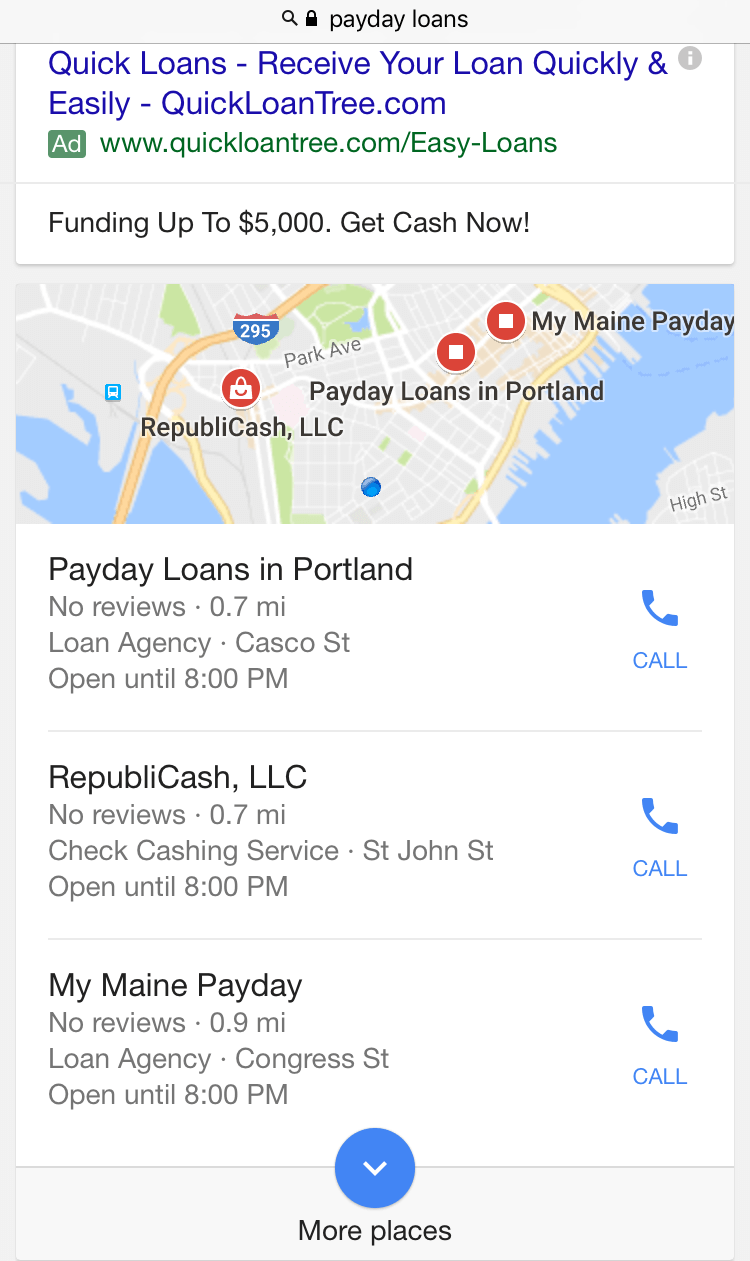

You probably have dozens of nearby payday lenders to choose from if you live in an urban or suburban area. Even yet in rural areas, you are able to often utilze the internet to locate a continuing company happy to provide you smaller amounts of cash.

Regrettably, not absolutely all of the payday loan providers are reputable. The simplest way to inform the essential difference between a safe cash advance and a scam would be to try to find organizations which are precisely certified. All licensed payday loan providers must follow strict regulations passed away by the state together with government. Simply because they need certainly to follow these guidelines, you realize you’ve got more protections from fraud.

Most safe lenders that are payday point out that they’re certified to their web sites. You can validate this given information by contacting a state’s attorney general. Remember that a lender that is online in one state might not have authority to provide cash to individuals staying in other states.

Just Just What Else If You Consider Whenever Trying To Find Safe On The Web Loans?

Finding a licensed loan provider isn’t the thing to take into account when looking for safe online loans. Some companies that promote themselves as loan providers don’t actually provide you money themselves. Alternatively, these are typically lead generation sites that distribute your unsecured loan information to online loan providers. It is often most readily useful not to ever provide your private information up to a site which will offer it with other organizations. You never understand where that information find yourself.

If you are uncertain in what an internet site does, ask if it is a lender that is direct. A lender that is direct all facets regarding the financing process. Being a direct lender (where  permitted), LendUp reviews your application, handles the approval procedure and sends your cash. Whenever you make repayments, you deliver the repayments to LendUp. It really is a process that is simple keeps your personal information secure. To examine, when looking for a payday that is safe, you need to make sure:

permitted), LendUp reviews your application, handles the approval procedure and sends your cash. Whenever you make repayments, you deliver the repayments to LendUp. It really is a process that is simple keeps your personal information secure. To examine, when looking for a payday that is safe, you need to make sure:

The lending company is certified in a state.

The mortgage can come straight through the business (where permitted).

The internet site will maybe perhaps maybe not circulate your details to many other businesses.

Why is LendUp a Safe Choice For Short-Term Loans?

LendUp has emerged as being a short-term financing option th a large amount of individuals find more appealing than payday loan providers. We just provide profit states where we’re licensed to use. In addition, you have the advantage of working straight together with your loan provider. LendUp reviews applications quickly and deposits your hard earned money into the bank-account. You don’t need to be worried about any third-party loan providers misusing your details. Simply put, LendUp provides the answers that are right the most crucial questions regarding safe loans.

LendUp does not stop here, though. In addition provides advantages you’ll not find from numerous payday loan providers. For example, LendUp does not have rollovers. Then you could fall into the same problem created by misusing credit cards if your lender uses rollovers. Whilst the balance rolls over from every month, you could sooner or later owe therefore money that is much it is very hard to get out of financial obligation.