Forex trading

Market participants

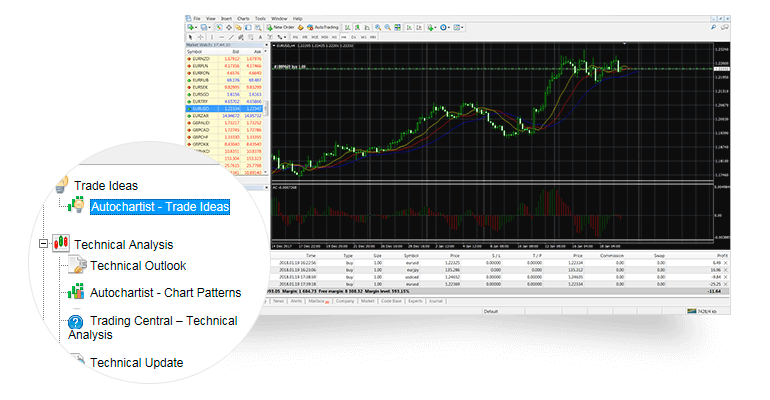

The display below shows the forex pair EUR/USD (Euro/US Dollar), one of the most common currency pairs used on the forex market. FXTM offers a number of different accounts, each providing services and features tailored to our clients’ individual trading objectives.

In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. The most common type of forward transaction is the foreign exchange swap.

Nevertheless, the effectiveness of central bank “stabilizing speculation” is doubtful because central banks do not go bankrupt if they make large losses as other traders would. There is also no convincing evidence that they actually make a profit from trading. An important part of the foreign exchange market comes from the financial activities of companies seeking foreign exchange to pay for goods or services. Commercial companies often trade fairly small amounts compared to those of banks or speculators, and their trades often have a little short-term impact on market rates. Nevertheless, trade flows are an important factor in the long-term direction of a currency’s exchange rate.

The EUR/USD rate represents the number of USD one EUR can buy. If you think the Euro will increase in value against the US Dollar, you buy Euros with US Dollars. If the exchange rate rises, you sell the Euros back, and you cash in your profit. Please keep in mind that maxitrade.blog involves a high risk of loss. With spread betting you stake a certain amount (in your account currency) per pip movement in the price of the forex pair.

75-80% of retail traders lose money. The country or region you trade forex in may present certain issues. For example, forex traders in the USA and Canada will need to read up on pattern trading rules (Canadian traders have it slightly easier).

Approximately $5 trillion worth of forex transactions take place daily, which is an average of $220 billion per hour. The market is largely made up of institutions, corporations, governments and currency speculators – speculation makes up roughly 90% of trading volume and a large majority of this is concentrated on the US dollar, euro and yen. Market sentiment, which is often in reaction to the news, can also play a major role in driving currency prices.

of retail investor accounts lose money when trading CFDs with this provider. of retail accounts lose money when trading CFDs with this provider.

Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate. A large difference in rates can be highly profitable for the trader, especially if high leverage is used. However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses. One way to deal with the foreign exchange risk is to engage in a forward transaction.

Forex Trading: A Beginner’s Guide

- Whatever the mechanism the aim is the same, to trigger trades as soon as certain criteria are met.

- FX trading allows you to speculate on price movements in the global currency market.

- With a market this large, finding a buyer when you’re selling and a seller when you’re buying is much easier than in in other markets.

- These currency pairs, in addition to a variety of other combinations, account for over 95% of all speculative trading in the forex market.

- Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars.

- A higher margin requirement may apply depending on the level of exposure.

Forex, also known as foreign exchange, FX or currency trading, is a decentralized global market where all the world’s currencies trade. The forex market is the largest, most liquid market in the world with an average daily trading volume exceeding $5 trillion. All the world’s combined stock markets don’t even come close to this. But what does that mean to you?

Trading forex at weekends will see small volume. Take GBP/USD for example, there are specific hours where you have enough volatility to create profits that are likely to negate the bid price spread and commission costs.

Forex trading, also known by the name of currency trading or FX trading, refers to buying a particular currency while selling another in exchange. Trading currencies always involves exchanging one currency for another. Participating in the forex trading market via a broker like XM means that the client receives access to real-time pricing of the forex market and is quoted buy and sell prices for a number of instruments via an online trading platform. The client has the freedom to decide at which price they decide to buy or sell, and vice versa, and can execute a transaction at any time they wish.

A last ditch attempt to hike UK rates that had briefly hit 15% proved futile. When the UK announced its exit from the ERM, and a resumption of a free-floating pound, the currency plunged 15% against the Deutsche Mark, and 25% against the US dollar. https://maxitrade.blog As a result, the Quantum Fund made billions of dollars and Soros became known as the man who broke the Bank of England. His feat can easily be featured in the list of the greatest forex traders to follow. National Futures Association (2010).

Plus500 Offer forex trading via CFDs with tight variable spreads and a range of well over 70 currency pairs. Free Unlimited Demo Account. 76.4% of retail accounts lose money.

From cash, margin or PAMM accounts, to Bronze, Silver, Gold and VIP levels, account types can vary. The differences can be reflected in costs, reduced spreads, access to Level II data, settlement or different leverage. Micro accounts might provide lower trade size limits for example. Try before you buy. Most credible brokers are willing to let you see their platforms risk free.

Forex.com are a leading forex broker. Offering the largest range of currency pairs (80+) and some of the tightest spreads in the industry. 69% of retail accounts lose money with this provider. Trade Forex on 0.0 pip spreads with the world’s leading True ECN forex broker – IC Markets.